U.S. Grain Markets Respond to Trade Aid

What’s Up In Food

By Joe Maginnis

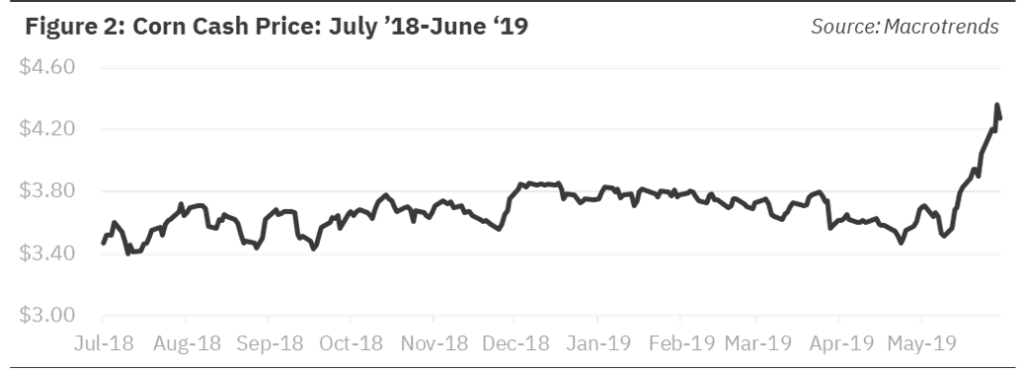

Corn prices skyrocketed to $4.20 per bushel in late May, reaching that mark for the first time since June 2016. Prior to the sudden spike, corn fundamentals had been deteriorating badly on the expectation that the U.S. corn stocks-to-use ratio would reach its highest level since the 05/06 crop year. The unexpected lift in the price of corn was driven by a perfect storm of supply fundamentals in U.S. grain markets. Let’s evaluate the series of events that led to the price movement below:

January 2018-Present: The U.S. – China trade war displaces global soybean fundamentals

Since January 2018, U.S. farmers have been dealing with retaliatory tariffs from the ongoing trade dispute with China, one of the top three export markets for U.S. agricultural goods. The trade dispute has been particularly hard on U.S. soybean growers, since China has historically imported over 60% of U.S. soybean production. Now that China has virtually halted all purchasing of U.S. soybeans, domestic stocks-to-use ratios on soybeans are projected to reach record levels.

March 2019-Present: A wet winter delays corn plantings

I wrote about this recently in the March Moon Letter. On March 12, a “bomb cyclone” dropped heavy rain and snow on the Midwest. The combination of spring thaw and sustained rain showers caused rivers in those states to rise to record levels and widespread flooding to occur. The flooding resulted in the evacuation of thousands from their homes, the destruction of critical infrastructure, and potentially billions dollars of lost crop production due to delayed planting. The bulk of corn planting typically takes between late-April and mid-May, but, due to the record moisture, over 70% of corn acreage remained unplanted as of May 20th.

May 23, 2019: The USDA announces a trade aid package for soybean farmers

In response to the worsening trade relations with the historically majority buyer of U.S. soybeans and other agricultural goods – and with an election looming where the current president will need support from rural America – the Trump Administration committed to providing $14.5 billion in direct payments to farmers of select commodities. The direct payments could be equivalent to as much as $2.00 per bushel for soybeans.

“The plan we are announcing today ensures farmers do not bear the brunt of unfair retaliatory tariffs imposed by China and other trading partners. Our team at USDA reflected on what worked well and gathered feedback on last year’s program to make this one even stronger and more effective for farmers.”

– Ag Secretary Sonny Perdue

Naturally, news of a large payment for soybean farmers would sway planting decisions on what little remaining acreage had yet to be planted in a typical year. However, this is not a typical year. When you consider the fact that 70% of corn area had yet to be planted as of May 20th this year, the news would be enough to drastically move grain markets, as we have now seen. The USDA did set the important restriction that no farmer would be able to collect payments on soybean acreage in excess of what the farmer had planted in the previous year, which should limit the impact on commodity markets. However, the farmers who over-planted in soybeans last year will be incentivized to do so again this year despite weakening global demand. It was this sudden displacement of corn acreage that had such a pronounced impact on commodity prices in late May.